The Free Liability Insurance

for Deliveroo riders

We've got you covered while you are out working

For all incidents taking place after the 30th June 2022 please make your claim here

We’ve got you covered when you are working

Free liability insurance against claims resulting from injuries and damages to other people or property.

Physical Injury

Up to £1,000,000 covered in case of injury to another person

Accidental Damage

Up to £1,000,000 covered in case of damage to another person’s goods, subject to a maximum excess of £150 paid by the rider

Legal Defence Costs

Up to £7,500 towards legal defence costs in case of a dispute or legal proceedings being brought against a rider

What is not covered?

Your mobile phone

Your clothes

Your bicycle

When you’re not working

Everything you need to know about your cover

Making a Claim is easy

How it works?

You can submit and follow your claims in real time directly on the Indeez platform

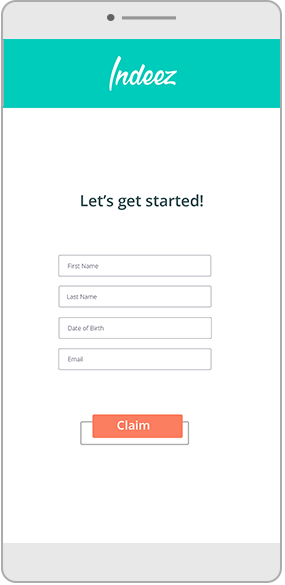

1. Open a claim

Visit the Indeez platform and complete the form as accurately as possible so that we can process your claim quickly

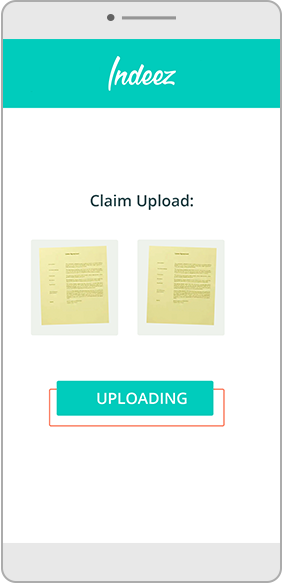

2. Provide additional information

We’ll review your claim and get back to you if we’re missing anything. If you respond quickly that will help us finalize your case faster!

3. Stay updated

We’ll keep you posted on our progress. And you can also check where we are up to directly on the Indeez platform

We’re doing our best to make your life safe & easy!

We're here to help

Please check our FAQ section to find a response to your question.

No, your free insurance does not cover property such as your cycle, bike, scooter or phone. But if you cause damage to another person’s property, this would be covered by the Rider Liability Insurance.

The Rider Liability Insurance covers substitutes provided you were working under the account of an active rider and in accordance with Deliveroo’s rider supplier agreement.

To make a claim is quick, simple and straightforward.

- Deliveroo Riders – You’ve caused injury/damage to someone (Third-Party) – If you require to make a liability claim in case you cause injury to someone whilst at work or in case you damage someone else’s property whilst working, please report to Indeez using the claim form here.

- Deliveroo Riders – You’ve been injured in an accident – If you were involved in an incident with a Deliveroo Rider, please report your liability claim to Indeez using the claim form here.

- Third-Party – If you require to make an accident claim in case you can’t work following an accident while working with Deliveroo, please report to Bikmo using the claim form here.

The more information you provide, the faster we can approve and make a payment for your claim. For example, please provide details of all third parties involved, details of the incident (location, time of day, circumstances), any physical injuries, police report number or any other piece of information you believe would be helpful in resolving your claim.

As a Deliveroo rider you are covered by our insurance whenever and wherever you’re out on the road with Deliveroo in the UK. This includes the whole time you’re online, as well as up to one hour after you go offline.

Who we are

At Indeez, our mission is to build a safety net for independent workers.

We want to bring you the best experience and make it painless for you to go through an insurance claim process!

This insurance is paid for by Deliveroo with Indeez arranging and administering the policy. We work together with AXA XL, our insurance partner and Crawford, our claim management partner, to bring you the very best insurance product and covers available to support you every day whilst working for Deliveroo.

Visit our website indeez.eu for more information about us!

Need more support or have a question?

Copyright © Indeez 2021

All rights reserved

Indeez SAS is listed on the Paris Trade and Companies Register under number 888 048 659 with its head office located at 19 rue du Rocher 75008 Paris, France. Indeez SAS, operating under the Indeez brand, is registered as insurance broker in the ORIAS Register, under number 20006983 (www.orias.fr).

In the UK, Indeez SAS is deemed authorised and regulated by the Financial Conduct Authority (FCA). The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the FCA’s website (www.fca.org.uk). Indeez SAS is listed on the financial services register (register.fca.org.uk) and its FCA registration number is 938582.